[WEEX VIP Spot Sprint] Best VIP Traders Awards: Win a Share of $100,000 in Rewards

In the past few years, trading competitions have become a common tool across crypto platforms. Most follow a familiar formula: open participation, aggressive incentives, and short-term excitement designed to boost surface-level activity. While these formats may attract attention, they often fail to resonate with traders who already operate at scale.

For professional and high-intent traders, the question is no longer whether rewards exist, but whether those rewards are aligned with real trading behavior.

This is where the WEEX VIP Spot Sprint draws a clear line.

Organized by WEEX, the event introduces a competition framework that does not attempt to gamify trading, but instead treats trading as a discipline — one defined by consistency, execution quality, and long-term control rather than isolated bursts of volume. With a $100,000 total prize pool, the championship is positioned not as a promotional spectacle, but as a performance-based extension of professional trading itself.

Moving Beyond Mass Participation Incentives

One of the structural weaknesses of most trading competitions lies in unrestricted participation. When entry is open to everyone, rewards are inevitably diluted, and leaderboards often reflect scale alone rather than skill. The result is an environment where serious traders compete alongside casual participants, with little meaningful differentiation.

The WEEX VIP Spot Sprint deliberately avoids this model.

By introducing clear qualification requirements and defined trading conditions, the competition establishes a baseline of trading activity, capital commitment, and intent. This immediately changes the nature of the leaderboard. Rankings become comparative rather than inflated, and performance is evaluated among participants operating under the same measurable standards.

In effect, the competition reduces noise from low-intent participation and emphasizes execution quality from the outset.

A Design That Mirrors Real Trading Conditions

There are no layered tasks, no side missions, and no engagement-based requirements. Participants trade eligible spot markets during the event period, and rankings are determined by effective trading volume — a metric that reflects sustained participation rather than momentary volatility.

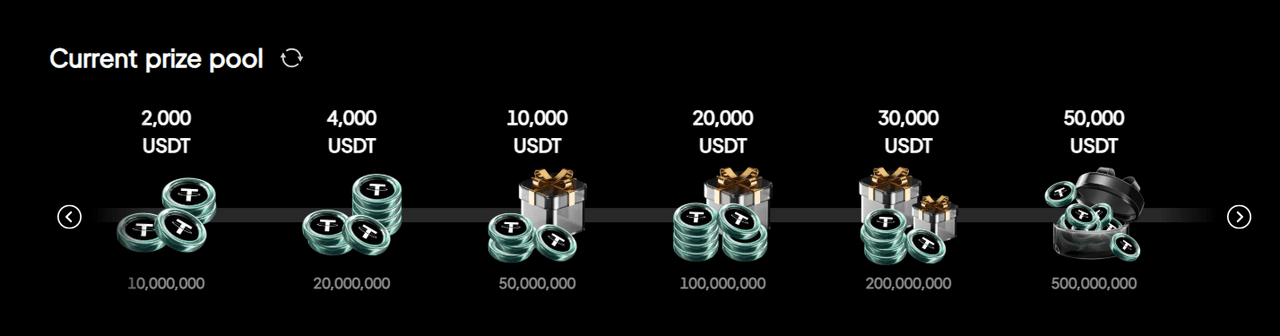

The prize pool grows as total trading volume increases.

As the combined effective trading volume generated by all participants reaches predefined thresholds, additional portions of the prize pool are unlocked. In other words, higher real trading activity across the competition directly leads to a larger total reward pool.

This structure ensures that rewards are expanded through genuine market participation rather than artificial engagement. Individual rankings still depend on personal performance, while the overall prize pool scales in line with collective trading activity.

This approach mirrors how professional traders already evaluate performance: not by a single trade, but by the cumulative result of decisions executed over time.

Traders are not asked to adapt to the competition. The competition adapts to how traders already operate.

Participation Starts With Registration and Volume Eligibility

Unlike open trading competitions that rely on complex onboarding tasks, participation in this campaign follows a clear and structured process.

To participate, traders must meet two conditions:

- Complete registration on WEEX

- Spot trading volume ≥ 5,000 USDT

Only trading volume generated after successful registration will be counted toward the competition leaderboard. Trading activity prior to registration does not qualify.

Once registered, no additional actions are required. There are no side missions, manual confirmations, or engagement-based tasks. From that point forward, all eligible trading activity during the event period will automatically count toward the competition.

What You Actually Need to Do During the Event

Participation in the WEEX VIP Spot Sprint is defined by trading behavior, not engagement actions.

During the event period, traders simply:

- Trade eligible pairs as usual(Eligible pairs: All spot trading pairs except ETH, ENS, PENDLE, LDO, UNI, AAVE, OP, and ARB.)

- Accumulate effective trading volume

- Compete for a higher ranking on the leaderboard

There is no need to alter strategies, increase unnecessary risk, or chase short-term volatility. The ranking is based on aggregate performance over time, meaning consistency matters more than isolated spikes.

This design ensures that the competition mirrors real trading conditions, rather than encouraging artificial behavior purely for ranking purposes.

How Traders are Ranked and Rewards Determined

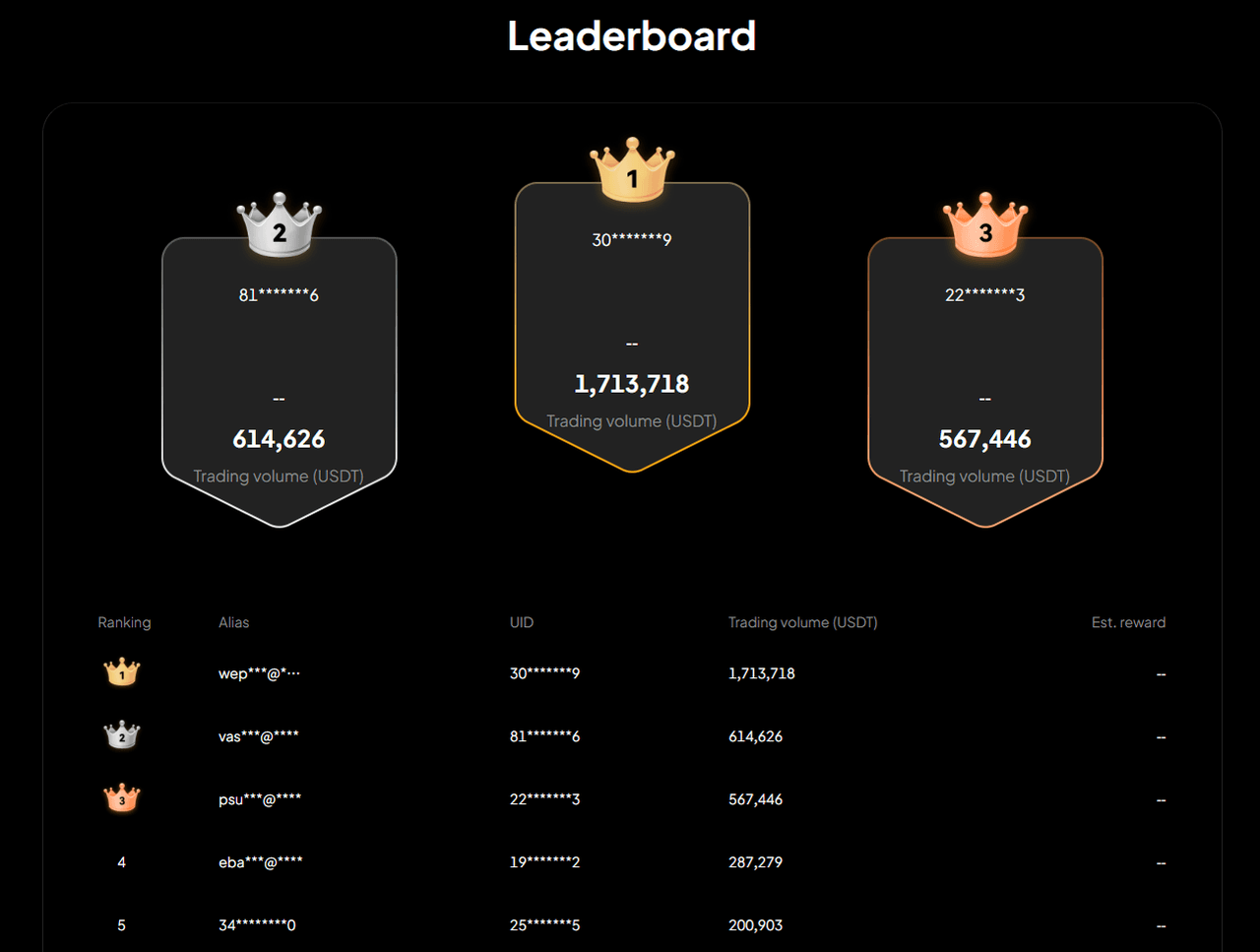

At the core of the event is a performance-based leaderboard.

All participating VIP traders are ranked according to their effective trading volume accumulated during the competition window. At the end of the event, the $100,000 prize pool is distributed based on final rankings.

There are:

- No random draws

- No social or referral requirements

- No rewards disconnected from trading outcomes

- Spot trading volume = buy volume + sell volume.

Every reward is tied directly to measurable execution.

For traders already operating at scale, this effectively means that routine trading activity can generate additional upside, without introducing new operational complexity.

Why This Event Stands Out

1. A Real Prize Pool, Not Marketing Noise

A $100,000 prize pool means the rewards are worth competing for, even for seasoned traders. This isn’t designed to “look big” — it is big.

2. Built for Consistency, Not One Lucky Trade

The leaderboard rewards sustained performance, not short-term spikes. That makes it ideal for traders who rely on discipline rather than volatility gambling.

3. Structured Participation = More Meaningful Rankings

Minimum trading requirements limit incidental participation.

Rankings reflect sustained activity rather than one-off trades.

Reward outcomes are based on comparable performance conditions.

From Normal Trading to Competitive Advantage

The WEEX VIP Spot Sprint is not about changing habits — it is about amplifying outcomes.

For high-volume traders, participation is less a decision and more a condition: trade as usual during the event period, and performance will determine the result. Key Details at a Glance:

- Event: WEEX VIP Spot Sprint

- Total Prize Pool: $100,000

- Eligibility: Spot trading volume ≥ 5,000 USDT

- Mechanism: Trading volume leaderboard

- Reward Type: Performance-based distribution

Full event details & registration: https://www.weex.com/events/trading-competition/vip100000

How to Participate

Eligible traders must register for the event on the official event page. Once registered, simply trade eligible spot markets (All spot trading pairs are eligible, except for ETH, ENS, PENDLE, LDO, UNI, AAVE, OP, and ARB) during the event period — all qualifying trading volume generated after registration will be counted automatically.

Please review the full rules and eligible markets on the event page before trading.

About WEEX

Founded in 2018, WEEX has developed into a global crypto exchange with over 6.2 million users across more than 150 countries. The platform emphasizes security, liquidity, and usability, providing over 1,200 spot trading pairs and offering up to 400x leverage in crypto futures trading. In addition to traditional spot and derivatives markets, WEEX is expanding rapidly in the AI era — delivering real-time AI news, empowering users with AI trading tools, and exploring innovative trade-to-earn models that make intelligent trading more accessible to everyone. Its 1,000 BTC Protection Fund further strengthens asset safety and transparency, while features such as copy trading and advanced trading tools allow users to follow professional traders and experience a more efficient, intelligent trading journey.

Follow WEEX on social media

Instagram: @WEEX Exchange

TikTok: @weex_global

YouTube: @WEEX_Global

Discord: WEEX Community

Telegram: WeexGlobal Group

You may also like

$15K+ Profits: The 4 AI Trading Secrets WEEX Hackathon Prelim Winners Used to Dominate Volatile Crypto Markets

How WEEX Hackathon's top AI trading strategies made $15K+ in crypto markets: 4 proven rules for ETH/BTC trading, market structure analysis, and risk management in volatile conditions.

A nearly 20% one-day plunge, how long has it been since you last saw a $60,000 Bitcoin?

Raoul Pal: I've seen every single panic, and they are never the end.

Key Market Information Discrepancy on February 6th - A Must-Read! | Alpha Morning Report

2026 Crypto Industry's First Snowfall

The Harsh Reality Behind the $26 Billion Crypto Liquidation: Liquidity Is Killing the Market

Why Is Gold, US Stocks, Bitcoin All Falling?

Key Market Intelligence for February 5th, how much did you miss out on?

Wintermute: By 2026, crypto had gradually become the settlement layer of the Internet economy

Tether Q4 2025 Report: USDT Market Cap Nears $190 Billion, Multiple Metrics Reach All-Time Highs

Kyle Samani's about-face, one of the biggest believers in web3, has also left the industry

Bhutan Quietly Sells Over $22M in Bitcoin, Drawing Speculation Over Possible Moves

Key Takeaways Bhutan has transferred over $22 million in Bitcoin from sovereign wallets in the past week. The…

BitMine Endures a $7B Unrealized Loss as Ethereum Dips Below $2,100

Key Takeaways BitMine is facing a significant financial challenge with an unrealized loss of over $7 billion in…

Trump-Linked World Liberty Financial Under Scrutiny Following $500 Million UAE Stake

Key Takeaways A U.S. House investigation is examining a $500 million UAE stake in Trump-related World Liberty Financial.…

Asia Market Open: Bitcoin Tumbles as Asian Equities Reflect Global Tech Retreat

Key Takeaways: Bitcoin’s price plunged by 6% to $72,000, reflecting the spillover effects from the global tech sector’s…

Crypto Firms Propose Concessions to Banks as Stablecoin Disputes Stall Key Crypto Bill

Key Takeaways: Crypto companies are attempting to navigate stablecoin disputes with banks but agreements remain elusive. Industry representatives…

CoolWallet Introduces TRON Energy Rental to Minimize TRX Transaction Costs

Key Takeaways CoolWallet has integrated TRON’s energy rental services, offering users lower transaction fees while maintaining asset security.…

CFTC Officially Withdraws Biden-Era Proposal to Ban Political and Sports Prediction Markets

Key Takeaways: The CFTC has rescinded a 2024 proposal and subsequent 2025 advisory that aimed to prohibit event…

$15K+ Profits: The 4 AI Trading Secrets WEEX Hackathon Prelim Winners Used to Dominate Volatile Crypto Markets

How WEEX Hackathon's top AI trading strategies made $15K+ in crypto markets: 4 proven rules for ETH/BTC trading, market structure analysis, and risk management in volatile conditions.

Earn

Earn![[WEEX VIP Spot Sprint] Best VIP Traders Awards: Win a Share of src=](https://images-cms.weex.com/Win_a_Share_of_100_000_in_Rewards_75e69c3539.PNG)