Is Solana About to Recover? Analyzing On-Chain MEME Whale Movement

Original Article Title: "Local Frenzy or Full Recovery? Data Analysis of Solana Chain MEME Whale Activity and Market Divergence"

Original Article Author: Frank, PANews

The MEME market seems to have heated up once again, starting in mid-March, with Fartcoin starting to rebound from its low, experiencing an approximately 349% increase over about a month, reaching a peak total market value of nearly 9.85 billion US dollars. At the same time, the on-chain activity of MEME whales has also attracted attention, with some whales investing millions of dollars in Fartcoin, RFC, and other MEME coins, leading to a rapid increase in related token market values.

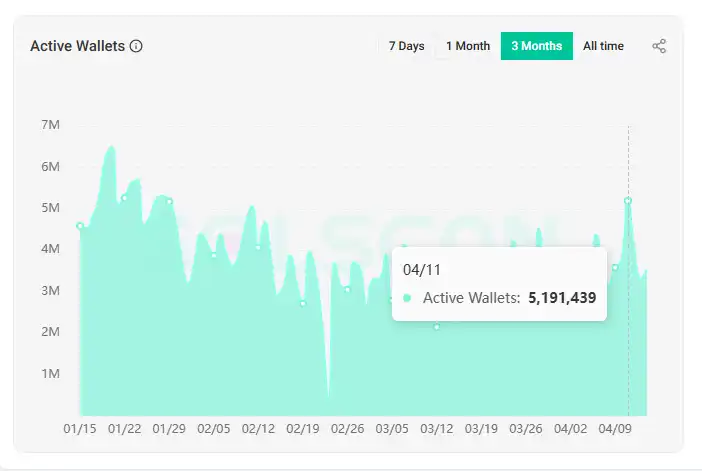

Behind these movements, on April 11, the number of active addresses on the Solana chain once again surpassed 5.1 million, nearing the peak level seen in January.

The minor outbreak of this MEME market rally, is it a return of the MEME bull market or a speculative resurgence in a boring market environment? PANews conducted data analysis on the large holder addresses of several recently surging MEME coins in hopes of finding some clues.

Fartcoin Analysis: Whale Entry in Mid-March, Average Cost Around $0.62

Firstly, after observing several previously high market cap tokens, PANews found that this round of MEME frenzy is not universal but rather concentrated in a few specific tokens. Most of the MEME tokens that previously had market caps over a billion (such as Trump, BONK, WIF, POPCAT) are still in a decline or bottoming phase. Among the tokens observed by PANews, except for Fartcoin, the other tokens are either new coins created in the past 1 to 2 months or tokens that have been lukewarm since their issuance. Here are several tokens observed by PANews: RFC, Fartcoin, ALCH, GOHOME, DARK, House, FAT.

The token selection criterion is a market cap ranging from 10 million to over 100 million US dollars, with tokens that have experienced significant increases or rebounds in the past 1 to 3 months. Among these, RFC has seen the largest increase, with a maximum increase of 54 times in the past month.

The leading token of this round is Fartcoin, which, after hitting a low on March 10, began a new upward trend. Its market cap once reached 9.48 billion US dollars, once again becoming the leader of the MEME trend.

Analysis of the first-time purchase time of whales reveals that the collective entry time of whales in this round started from mid-March and continued until April 10, with whale entry maintaining an upward trend.

Fartcoin Whale Entry Time Distribution

In terms of cost, the initial purchases of the top 1000 whales are mostly concentrated between $0.2-$0.6 and $0.6-$0.9. Looking at the Fartcoin chart, the percentage of whales still trapped above $1 is relatively small. Overall analysis shows that the current holding whales mostly entered the market after the price low on March 12.

Fartcoin Whale Holding Cost Distribution

In total, the average holding cost of Fartcoin whales' initial purchases is about $0.62. Based on the current price of $0.844, these new whales have an average profit margin of about 36%.

23% of Addresses Have Cross-Asset Holdings, DARK and RFC Replay the Same Story

Looking at the overall picture, by comparing the top 1000 whale holders of these tokens, it is found that 23% of whale addresses hold at least 2 or more different tokens. Among them, the most held token by whales is DARK, a token with the shortest creation time, but 116 whales hold this token repeatedly.

Next, RFC has the highest number of repeat occurrences, reaching 110 times. Fartcoin has recently received high market attention and also has the highest market value among the analyzed tokens, but it has only appeared 76 times in repetitions. However, according to PANews analysis, the reason for this may be that Fartcoin's market value has already risen to a relatively high level, and many large holders have exited or switched tokens. As specific historical information of whale holdings at a particular time cannot be tracked, we currently cannot provide a definitive answer.

However, from the analysis of RFC and DARK, it seems that these two tokens have a somewhat similar storyline.

First of all, let's look at the candlestick chart trends of the two. Apart from the difference in creation time, the trends, including pullback patterns, tend to be similar.

Furthermore, the data on whale holdings of these two tokens are also quite similar, both being above 110. In a more detailed analysis, PANews observed that there are 75 addresses simultaneously holding the DARK and RFC tokens, which is the largest number in the whale holding combinations. The next is the Fartcoin and House combination, with 35 addresses simultaneously holding these two tokens.

Looking further into the timing of these addresses holding RFC and DARK simultaneously, most whale addresses initially bought these two tokens on April 13th and April 14th, respectively.

From the perspective of the candlestick chart trends, April 13th was precisely the date of RFC's rapid surge, with a one-day increase of 65% and a swing of 107%. On April 14th, DARK saw a similar market movement, with a one-day increase of 80% and a swing of 218%. This significant surge one after another appears to be a coordinated pumping action.

Whale First Purchase Distribution Date of RFC

Whale First Purchase Distribution Date of DARK

Of course, it is worth noting that the market value of RFC reached as high as $138 million, while DARK's peak market value was only $23 million. It seems that the whales behind these tokens are not the absolute dominant force in the market, or the whales' expectations for these two tokens are not the same. Therefore, it cannot be assumed that DARK will replicate RFC's market value.

Additionally, tokens such as Fartcoin and House or DARK and House appear frequently in whale holdings.

“Artificial Bull” Embraces MEME Culture and AI

In the overall data, the total holding amount of these whale addresses with repeated holdings in these 7 tokens is approximately $100 million (excluding holdings by major exchanges such as Gate, Bitget, Raydium), accounting for 8.47% of the market value of these tokens.

As of early April 16, these tokens have also experienced a certain degree of pullback. Among them, FAT has retraced by 72.51% from its peak, House has retraced by 50%, with an overall average retracement of 37.12%. Among them, only ALCH has seen a smaller retracement, which, from its nature, is the only AI-related token with practical applications. However, from a cyclical perspective, ALCH may just happen to be in a phase of market rotation without entering a selling cycle.

Behind this MEME rotation surge, there seems to be some traces of an artificial MEME bull market. KOL @MasonCanoe stated on Twitter that the whale address responsible for the rise in RFC is associated with addresses that have engaged in market-making activities for previous tokens such as TRUMP, VIRTUAL, LIBRA, and is also associated with several addresses that were early stakeholders in RFC. Based on this, @MasonCanoe believes that the pump in RFC is by no means accidental and may be a signal of careful positioning by large funds.

From a data perspective, MEME on Solana's blockchain does seem to be once again capturing market attention under the impetus of some whales. However, since this driving effect cannot benefit all MEME tokens, it can only be judged by tracking the real-time dynamics of these main funds. Additionally, from the classification of several tokens, tokens with cat, dog, and frog themes seem to have not occupied a significant position in the recent surge, mainly with AI and MEME culture tokens showing outstanding performance.

Overall, this recent MEME craze on Solana's blockchain has not blossomed across the board but has been highly concentrated on a few specific tokens, with Fartcoin as the leader attracting a large number of new high-net-worth individuals who entered the market in mid-March. Of greater note is the fact that behind the trends of RFC and DARK, two highly similar tokens, there are numerous overlapping whale addresses holding both tokens, with their main buying times concentrated around the sharp surges on April 13 and 14, strongly implying possible coordinated actions or main fund rotation behavior. This surge seems to be not purely a result of organic market behavior but carries traces of an "artificial bull market," and whether this "artificial rain" can evolve into natural capital inflows is still to be observed.

You may also like

Giannis Antetokounmpo's Investment in Kalshi Sparks Outrage: Idol Crossover or Insider Trading Scheme?

Mr. Beast Acquires Step: Top Streamer Enters Teen Finance Race?

Not Just Guessing Right or Wrong, Market Prediction Is Getting More and More “Fun”

$55,000 will be Bitcoin's make-or-break level

February 10th Key Market Information Gap, A Must-See! | Alpha Morning Report

About ERC-8004: Everything You Need to Know

ai.com's Debut Flop: After $70 Million Transaction, Did It Get a '504' Timeout?

FedNow versus The Clearing House: Who Will Win the Fed Payments Fray?

Recovering $70,000 in Lost Funds: The "Fragile Logic" Behind Bitcoin's Rebound

Mr. Beast acquires Step, Farcaster Founder Joins Tempo, what are the international crypto circles talking about today?

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…